First Vanadium Announces Second & Final Tranche Closing of $6,000,000 Private Placement Financing

Vancouver, British Columbia--(Newsfile Corp. - May 13, 2021) - First Vanadium Corp. (TSXV: FVAN) (OTCQX: FVANF) (FSE: 1PY) ("First Vanadium" or the "Company") announces that further to its April 15, 2021 and May 6, 2021, news releases, it has now completed the second and final tranche (the "Second Tranche") of its non-brokered private placement (the "Offering"). Under the Second Tranche, the Company has issued 1,346,000 units for gross proceeds of $538,400. No finder's fees were paid in connection with the Second Tranche. All securities issued under the Second Tranche are subject to a hold period expiring September 13, 2021 in accordance with applicable securities laws and the policies of the TSX Venture Exchange.

Together with the first tranche closing announced May 6, 2021, the Company has now raised a total of $6,000,000.

Paul Cowley, President & CEO of the Company, commented: "We are very pleased to have completed this fully subscribed financing as it will provide us with the funding for our 2021 gold exploration push on the Carlin and AVP properties. I would like to thank Rob McEwen and Eric Muschinski for their significant support in this financing, each having purchased 1,000,000 units ($400,000). To them, and to all of our shareholders, we thank you for your continuing support."

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933 (the "1933 Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons (as defined in the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration is available.

The Company also announces that, pursuant to the Company's 10% rolling stock option plan and in compliance with the policies of the TSX Venture Exchange, it has granted incentive stock options to certain directors, officers, and consultants of the Company to purchase up to an aggregate of 1,840,000 common shares of the Company. These options are exercisable for a period of 5 years at a price of $0.59 per share.

About First Vanadium Corp.

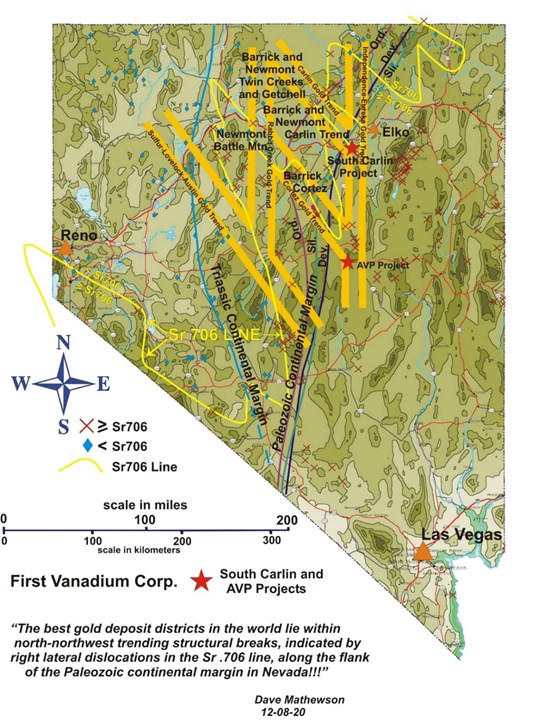

First Vanadium has an option to earn a 100% interest in the Carlin Gold-Vanadium Project, located in Elko County, 6 miles south from the town of Carlin, Nevada and Highway I-80. The Project lies in the Carlin Gold Trend. The Carlin Gold-Vanadium Project also hosts the Carlin Vanadium deposit.

ON BEHALF OF FIRST VANADIUM CORP.

per: "Paul Cowley"

Paul Cowley, CEO & President

(604) 340-7711

This email address is being protected from spambots. You need JavaScript enabled to view it.

www.firstvanadium.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

Certain statements in this news release constitute "forward-looking" statements. These statements relate to future events or the Company's future performance. All such statements involve substantial known and unknown risks, uncertainties and other factors which may cause the actual results to vary from those expressed or implied by such forward-looking statements. Forward-looking statements involve significant risks and uncertainties, they should not be read as guarantees of future performance or results, and they will not necessarily be accurate indications of whether or not such results will be achieved. Actual results could differ materially from those anticipated due to a number of factors and risks. Although the forward-looking statements contained in this news release are based upon what management of the Company believes are reasonable assumptions on the date of this news release, the Company cannot assure investors that actual results will be consistent with these forward-looking statements. Readers should not place undue reliance on forward-looking statements. The forward-looking statements contained in this press release are made as of the date hereof and the Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required under applicable securities regulations.

Not for distribution to United States newswire services or for dissemination in the United States.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/83996

First Vanadium Announces $5,461,600 First Tranche Closing of Private Placement Financing

Vancouver, British Columbia--(Newsfile Corp. - May 6, 2021) - First Vanadium Corp. (TSXV: FVAN) (OTCQX: FVANF) (FSE: 1PY) ("First Vanadium" or the "Company") announces that it has closed the first tranche (the "First Tranche") of its non-brokered private placement (the "Offering") previously announced on April 15, 2021. Under the First Tranche, the Company has issued 13,654,000 units for gross proceeds of $5,461,600.

In connection with the First Tranche, the Company paid a total of $60,130 and issued a total of 150,325 non-transferable warrants as finder's fees. Each finder's warrant is exercisable for one common share at a price of $0.55 for three years.

Certain directors and officers of the Company (the "Insiders") participated in the First Tranche and purchased an aggregate of 375,000 units for aggregate gross proceeds of $150,000 (Paul Cowley, the Company's President, CEO and a director, purchased 250,000 units for $100,000, and John Anderson, a director of the Company, purchased 125,000 units for $50,000). Participation by Insiders in the private placement is considered a "related party transaction" pursuant to Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Company is exempt from the requirements to obtain a formal valuation and minority shareholder approval in connection with the Insiders' participation in the private placement in reliance of sections 5.5(a) and 5.7(a) of MI 61-101, respectively, on the basis that participation in the Offering by the Insiders did not exceed 25% of the fair market value of the Company's market capitalization. The Company did not file a material change report at least 21 days prior to the First Tranche closing of the Offering as participation of the Insiders had not been confirmed at that time.

All securities issued under the First Tranche are subject to a hold period expiring September 6, 2021, in accordance with applicable securities laws and the policies of the TSX Venture Exchange.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933 (the "1933 Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons (as defined in the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration is available.

About First Vanadium Corp.

First Vanadium has an option to earn a 100% interest in the Carlin Vanadium Project, located in Elko County, 6 miles south from the town of Carlin, Nevada and Highway I-80. The Project lies in the Carlin Gold Trend. The Carlin Vanadium-Gold Project also hosts the Carlin Vanadium deposit.

ON BEHALF OF FIRST VANADIUM CORP.

per: "Paul Cowley"

Paul Cowley, CEO & President

(778) 655-4311

This email address is being protected from spambots. You need JavaScript enabled to view it.

www.firstvanadium.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

Certain statements in this news release constitute "forward-looking" statements. These statements relate to future events or the Company's future performance. All such statements involve substantial known and unknown risks, uncertainties and other factors which may cause the actual results to vary from those expressed or implied by such forward-looking statements. Forward-looking statements involve significant risks and uncertainties, they should not be read as guarantees of future performance or results, and they will not necessarily be accurate indications of whether or not such results will be achieved. Actual results could differ materially from those anticipated due to a number of factors and risks. Although the forward-looking statements contained in this news release are based upon what management of the Company believes are reasonable assumptions on the date of this news release, the Company cannot assure investors that actual results will be consistent with these forward-looking statements. Readers should not place undue reliance on forward-looking statements. The forward-looking statements contained in this press release are made as of the date hereof and the Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required under applicable securities regulations.

Not for distribution to United States newswire services or for dissemination in the United States.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/83212

First Vanadium Announces up to $6,000,000 Private Placement Financing

Vancouver, British Columbia--(Newsfile Corp. - April 15, 2021) - First Vanadium Corp. (TSXV: FVAN) (OTCQB: FVANF) (FSE: 1PY) ("First Vanadium" or the "Company") announces that it proposes to undertake a non-brokered private placement of up to 15,000,000 units (the "Units") at a price of $0.40/Unit to raise total gross proceeds of up to $6,000,000 (the "Offering"). Each Unit will be comprised of one common share and one-half (0.5) of one warrant. Each whole warrant will entitle the holder thereof to purchase one common share for a period of 3 years at a price of $0.55.

The gross proceeds received from the sale of the Units will be used for work programs on the Company's exploration properties and for general working capital.

The Company may pay finders' fees comprised of cash and/or non-transferable warrants in connection with the Offering, subject to compliance with the policies of the TSX Venture Exchange. All securities issued and sold under the Offering will be subject to a hold period expiring four months and one day from their date of issuance. Completion of the Offering and the payment of any finders' fees remain subject to the receipt of all necessary regulatory approvals, including the approval of the TSX Venture Exchange.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933 (the "1933 Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons (as defined in the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration is available.

ON BEHALF OF FIRST VANADIUM CORP.

per: "Paul Cowley"

Paul Cowley, CEO & President

(604) 340-7711

This email address is being protected from spambots. You need JavaScript enabled to view it.

www.firstvanadium.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

Certain statements in this news release constitute "forward-looking" statements. These statements relate to future events or the Company's future performance and include the Company's ability complete the proposed non-brokered private placement financing on the terms as described above. All such statements involve substantial known and unknown risks, uncertainties and other factors which may cause the actual results to vary from those expressed or implied by such forward-looking statements. Forward-looking statements involve significant risks and uncertainties, they should not be read as guarantees of future performance or results, and they will not necessarily be accurate indications of whether or not such results will be achieved. Actual results could differ materially from those anticipated due to a number of factors and risks. Although the forward-looking statements contained in this news release are based upon what management of the Company believes are reasonable assumptions on the date of this news release, the Company cannot assure investors that actual results will be consistent with these forward-looking statements. Readers should not place undue reliance on forward-looking statements. The forward-looking statements contained in this press release are made as of the date hereof and the Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required under applicable securities regulations.

Not for distribution to United States newswire services or for dissemination in the United States.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/80519

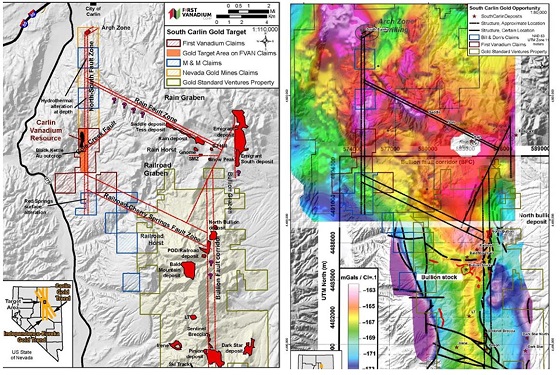

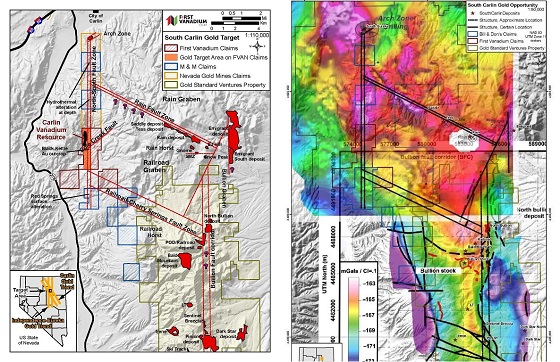

First Vanadium Identifies The Root System to Its Carlin-Type Gold System on the Carlin Gold Trend - Large and Untested

Vancouver, British Columbia--(Newsfile Corp. - March 15, 2021) - First Vanadium Corp. (TSXV: FVAN) (OTCQX: FVANF) (FSE: 1PY) ("First Vanadium" or the "Company") is pleased to provide initial results from its Induced Polarization (IP) survey over the gold system on its Carlin Gold-Vanadium Property on the Carlin Gold Trend of Nevada. Dave Mathewson, Geological Advisor and Jim Wright, former Newmont senior geophysicist, have identified part of the large north-south oriented root system to the much larger sulfide plume related to the gold system by IP. The Company's IP survey to date demonstrates the large root system with a strike length of at least 1.2 kilometres (0.75 miles) long (north-south), up to 750 metres (2460 ft) wide (east-west) and >500 metres (>1640 ft) vertically. The root system is open-ended to the north and south and remains untested by drilling to date.

IP was largely used in the discovery of the Betze, Screamer, Rodeo, Griffin and Deep Star gold mines on the Carlin Gold Trend. Root systems of Carlin-type gold systems generally contain higher sulfide content (detected by IP) and higher-grade gold portions of Carlin systems.

Figure 1: Line 2 IP Chargeability Inverted Section - untested root system/Chargeability anomaly and RC20-01

Dave Mathewson states, "This is an exciting development. Our IP survey solidifies and advances our thinking significantly, forming a new stage of probability. Our drilling results coupled with the IP survey is a powerful combination of exploration tools to vector into the hot spots comprising the gold feeder zones of the system. The positive surprises from both drilling and IP demonstrate the system is bigger than anticipated and thus the significance of the system and the importance of smart vectoring tools in such a large system. The one exploration tool complements and enhances the other. The geology (rock type, breccias and depths) and extent and zonation of sulfides, multi-element mineralization and alteration found in drilling allowed for best design criteria to set-up the IP survey, a more reliable interpretation of the IP results and better vectoring into the more favourable portions of the root system. The IP now shows the overall size, shape and location of the root system and points to higher sulfide portions. I am very encouraged with these results and keen to test the root system with our next stage of sharpshoot drilling."

According to Jim Wright, geophysicist, the IP data quality is excellent with clear depth penetration in the order of 800 m (2625 ft), giving rise to a good solid moderate to strong chargeability anomaly, typical of abundant sulfides. Average chargeability amplitudes (a reflection of disseminated sulfide content) are in the 25-30 millisecond range. The current drilling which shows to be off the shoulder of the anomaly contains between 3-10% sulfides, therefore, the root system is interpreted to likely have much stronger sulfide content. For context, 3-10% sulfide content is strikingly similar to typical sulfide amounts within and around the major gold mines in the Carlin Trend. And, typically, the higher the sulfide content, the higher the gold values tend to be in the system. The IP survey also produced coincident strong resistivity lows likely caused by argillic alteration.

Figure 2: Line 3 IP Chargeability Inverted Section - note untested root system relative to RC20-05 and 06

Figures 1 and 2 are two of the east-west IP sideview cross-sections or Inverted sections, 400m apart, that demonstrate the core of the untested chargeability anomaly or root system with depth, and its proximity to drilling. The upper contact of the lower plate Rodeo Creek and Popovich units are interpreted from drill data. The anomaly coincides with Rodeo Creek and Popovich units. Rodeo Creek and Popovich units are the host rocks to the majority of the big, and also the compact high grade gold deposits and mines in the Carlin Trend.

Jim Wright has produced a 3D model of the open-ended lengthy anomaly from the three lines of IP collected to date (Line 2, 3 and 4). To best demonstrate the anomaly within Rodeo Creek rocks, a slice of the 3D model, 300m below the surface is draped over the surface in Figure 3 with the context of the 1.4km (0.9 miles) stretch of drilling and surface outcrops of gold to the south. Future IP lines will fill-in to the south and north on this figure, subsequently. This figure demonstrates the north-south length (>1.2km), width (up to 750m) and strength (moderate-strong) of the anomaly that is open-ended both north and south. Clearly, the root system has not been tested by drilling which test just east of the anomaly. The southern projection of the root system projects to surface exposures of gold-arsenic-mercury near holes RC20-02 and 03, giving support to the southern continuation of the root system. Holes RC20-02, 03 and 04 did not reach the desired depth.

Figure 3: IP Chargeability Level Plan 300m Below Surface - large root system/Chargeability Anomaly in orange

On February 2, 2021, management reported visual observations from the remaining 4 drill holes, RC20-04 through RC20-07, declaring "the target is evolving very nicely with many positive qualities of substance. Drilling to date has delivered proof of a gold system with widespread solid attributes, similar to deposits and mines on the Carlin Trend; favourable depth, rock host, size, and intensity and extent of brecciation, sulfides, pathfinder metallization, and alteration (silica and dolomite)." Dave Mathewson continues, "The expression of the system is very strong in the holes and very importantly, in the right set of rocks. There is no doubt these positive features reflect the proximity of these holes to the root system now known from the IP program. "

Assays and geochemical analyses have now been received for the remaining 4 holes. Reflecting proximity to the root system, all typical pathfinder elements used to define a Carlin gold system are strongly present in these holes; arsenic, antimony and mercury and to a lesser extent thallium, silver, barium and zinc. And, the zonations displayed from these pathfinder elements point favourably immediately westward towards the root system. Other pathfinder elements, such as calcium and magnesium are expressing substantial continuous dolomite alteration in holes RC20-02, 03, 04 and 07; hole RC20-04 has 320 m (1050 ft) of continuous dolomite altered rock. Holes RC20-05, 06 and 07 show a 100m (330 ft) long section of strong quartz-dolomite alteration focused either side of Rodeo Creek-Popovich contact.

Gold is found in mild levels (6-45 ppb Au) in all four holes in Woodruff, Rodeo Creek and Popovich units over extensive portions of each hole and correspond to collapse breccia sections. Between 35-55% of the entire hole length of RC20-01, 02, 05 and 06, and over 20% of the entire hole length of RC20-07 average 10 ppb Au, indicative of the edges of a large gold system. These lengthy elevated sections display a somewhat stratified shallow dipping lateral continuity between all seven holes completed to date. These same sections have corresponding elevations in arsenic (300-1550ppm), antimony (25-87ppm) and mercury (5-420ppm), demonstrating extensive fluid migration into the stratigraphy from the west (the root system).

Dave Mathewson states, "These rock units that we are drilling, Rodeo Creek and Popovich, are the best rocks along the Carlin Trend to host gold deposits and the system is strongly evident on our property from IP and drilling to date. We continue to gain a much clearer picture of the system and targeting. Additional IP lines will just add to the picture of the root system. Furthermore, I have seen in other deposits on the trend, dramatically improved gold values over short distances (50-100m), the closer in proximity one is to the main conduit or root system. Thus, we plan to trace these extensive elevated gold sections in our holes back to the root system for improved gold grades. I am very encouraged with these assay and geochemistry results and keen to test the root system with our next round of sharpshoot drilling."

About First Vanadium Corp.

First Vanadium has an option to earn a 100% interest in the Carlin Gold-Vanadium Project, 6 miles south from the town of Carlin, Nevada and Highway I-80. The Project lies in the Carlin Gold Trend. Approximately 9 million ounces comprised of multiple gold deposits, including past producing mines, are present near the FVAN property (5-15km). The Carlin Gold-Vanadium Project also hosts the Carlin Vanadium deposit.

ON BEHALF OF FIRST VANADIUM CORP.

per: "Paul Cowley"

CEO & President (778) 655-4311 This email address is being protected from spambots. You need JavaScript enabled to view it. www.firstvanadium.com

Technical disclosure in this news release has been reviewed and approved by Dave Mathewson, a Qualified Person as defined by National Instrument 43-101, and Geological Advisor to the Company.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

Certain statements in this news release constitute "forward-looking" statements. These statements relate to future events or the Company's future performance and include the Company's ability to meet its obligations under the Access and Mineral Lease Agreement and the conditions required to exercise in full its option to acquire the Carlin Vanadium project, to finance and drill test the interpreted gold target model and to encounter potential gold zones shown in the gold model. All such statements involve substantial known and unknown risks, uncertainties and other factors which may cause the actual results to vary from those expressed or implied by such forward-looking statements. Forward-looking statements involve significant risks and uncertainties, they should not be read as guarantees of future performance or results, and they will not necessarily be accurate indications of whether or not such results will be achieved. Actual results could differ materially from those anticipated due to a number of factors and risks. Although the forward-looking statements contained in this news release are based upon what management of the Company believes are reasonable assumptions on the date of this news release, the Company cannot assure investors that actual results will be consistent with these forward-looking statements. The forward-looking statements contained in this press release are made as of the date hereof and the Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required under applicable securities regulations.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/77241

First Vanadium Reports Encouraging Visual Assessment from Latest Drilling on Its Gold Target on the Carlin Gold Trend, Nevada

Vancouver, British Columbia--(Newsfile Corp. - February 2, 2021) - First Vanadium Corp. (TSXV: FVAN) (OTCQX: FVANF) (FSE: 1PY) ("First Vanadium" or the "Company") is pleased to provide visual observations from the four holes drilled in November and December into its gold target within the Carlin Vanadium-Gold Property on the Carlin Gold Trend of Nevada. Assays for the four holes, RC20-04 through RC20-07, will be reported promptly upon receipt.

Prior to analytical data and assay results, management is taking this opportunity to comment on what is known at this point:

Dave Mathewson states, "The target is evolving very nicely with many positive qualities of substance. Drilling to date has delivered proof of a gold system with widespread solid attributes, similar to deposits and mines in the Carlin Trend; favourable depth, rock host, size, and intensity and extent of brecciation, sulfides, pathfinder metallization, and alteration."

Rock Units: All 7 holes provide us with prospective rock units and geological framework; at surface is upper plate Woodruff rocks to an average depth of about 260m (850ft), followed by lower plate Rodeo Creek rocks to a vertical depth of approximately 490m (1600ft), followed by Popovich rocks. These are the host rocks, in particular Rodeo Creek and Popovich, to the majority of the big, and also the compact high grade gold deposits and mines in the Carlin Trend.

Sulfides: The amount of disseminated and veined pyrite in holes RC20-05 through -07 varies between 2 and 10 % within the Rodeo Creek and Popovich units (the Rodeo Creek in hole 4 was oxidized). This amount of sulfide not only signifies a large sulfide plume indicative of a large system, but is strikingly similar to typical amounts in the major mines in the Carlin Trend. It also means the geophysical IP program in progress will provide a vital picture of the size, shape and orientation of the system, including, prospectively, the important feeders to the system, a critical vectoring tool for subsequent drilling.

Collapse Breccia: There are more breccias in RC20-04 through -07 than in RC20-01. Approximately 65% of the Rodeo Creek and Popovich rocks cut in RC20-05 and -07 show collapse brecciation, and approximately 50% in RC20-06. Collapse breccias are a clear sign of decalcification leading to increased porosity for gold solutions to migrate into and mineralize the open spaces. Collapse breccias are a vital element to most of the large deposits in the Carlin Trend. The amount of brecciation in holes RC20-01 and RC20-04 through -07 is similar to deposits and mines in the Carlin Trend.

Silicification (quartz): Much of the Rodeo Creek rocks cut in RC20-01 and RC20-04 through -07 are significantly silicified, pervasively and veined; Popovich rocks cut in RC20-01 and RC20-05 through -07 are intensely and pervasively silicified.

Dolomite Alteration: There is dolomite and ferro-dolomite present within the Rodeo Creek and Popovich rocks in holes RC20-01, and RC20-04 through -07. Dolomite is a key alteration mineral both proximal to, and within the collapse breccia hosted Carlin Trend gold deposits.

Results from RC20-01 through -03, previously reported, define a Carlin-style gold system with dimensions of at least 500m vertically and 1.4kilometre long. The gold target opportunity was identified by renowned geologist and mine-finder Dave Mathewson, a former Newmont Regional Exploration Manager who is the Company's Geological Advisor and is the Qualified Person spearheading and supervising the gold drilling program.

Holes RC20-04 through -07 were drilled between RC20-01 and -02. Hole RC20-04, drilled eastward at a 55o angle to a depth of 1100ft, is located 830m south of hole RC20-01. RC20-05, drilled eastward at a 75o angle to a depth of 2240ft, is located 430m south of RC20-01. Hole RC20-06 is located from the same drill pad as RC20-05, drilling eastward to a depth of 2240ft but at a shallower angle of 60o. Hole RC20-07, drilled eastward at a 60o angle to a depth of 2500ft, is located 720m south of RC20-01.

The IP geophysical survey is progressing with 2 lines of a planned 6 lines completed to date over the square mile where drilling has been focused. IP results will be reported promptly upon receipt.

About First Vanadium Corp.

First Vanadium has an option to earn a 100% interest in the Carlin Vanadium Project, located in Elko County, 6 miles south from the town of Carlin, Nevada and Highway I-80. The Project lies in the Carlin Gold Trend. Approximately 9 million ounces comprised of multiple gold deposits, including past producing mines, are present near the FVAN property (5-15km). The Carlin Vanadium-Gold Project also hosts the Carlin Vanadium deposit.

ON BEHALF OF FIRST VANADIUM CORP.

per: "Paul Cowley"

CEO & President

(778) 655-4311

This email address is being protected from spambots. You need JavaScript enabled to view it.

www.firstvanadium.com

Technical disclosure in this news release has been reviewed and approved by Dave Mathewson, a Qualified Person as defined by National Instrument 43-101, and Geological Advisor to the Company.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

Certain statements in this news release constitute "forward-looking" statements. These statements relate to future events or the Company's future performance and include the Company's ability to meet its obligations under the Access and Mineral Lease Agreement and the conditions required to exercise in full its option to acquire the Carlin Vanadium project, to finance and drill test the interpreted gold target model and to encounter potential gold zones shown in the gold model. All such statements involve substantial known and unknown risks, uncertainties and other factors which may cause the actual results to vary from those expressed or implied by such forward-looking statements. Forward-looking statements involve significant risks and uncertainties, they should not be read as guarantees of future performance or results, and they will not necessarily be accurate indications of whether or not such results will be achieved. Actual results could differ materially from those anticipated due to a number of factors and risks. Although the forward-looking statements contained in this news release are based upon what management of the Company believes are reasonable assumptions on the date of this news release, the Company cannot assure investors that actual results will be consistent with these forward-looking statements. The forward-looking statements contained in this press release are made as of the date hereof and the Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required under applicable securities regulations.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/73446

First Vanadium Receives Exchange Acceptance of AVP Property Option Agreement, in Battle Mtn - Eureka Gold Trend, Nevada

Vancouver, British Columbia--(Newsfile Corp. - January 22, 2021) - First Vanadium Corp. (TSXV: FVAN) (OTCQX: FVANF) (FSE: 1PY) ("First Vanadium" or the "Company") Further to its press release of January 14, 2021, the Company is pleased to announce that it has now received TSX Venture Exchange acceptance of the property option agreement to acquire the AVP Property. As a result, it has made the initial option payment of US$25,000 and has issued 250,000 common shares to the owner of the property in accordance with the terms of the agreement. These shares are subject to a hold period expiring May 22, 2021, in accordance with applicable securities laws and the policies of the TSX Venture Exchange.

The AVP Property Option Agreement is with Dave Mathewson for a property he has held and planned to drill himself for a number of years in the Battle Mountain - Eureka Gold Trend. Mr. Mathewson is a renowned Nevada gold specialist and proven mine finder. The option on the AVP Property will further strengthen Dave Mathewson's position and engagement in First Vanadium Corp. with additional stock in the Company and will spearhead and supervise the exploration on both AVP Property and the Carlin Vanadium-Gold Project.

ON BEHALF OF FIRST VANADIUM CORP.

per: "Paul Cowley"

CEO & President

(778) 655-4311

This email address is being protected from spambots. You need JavaScript enabled to view it. www.firstvanadium.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/72641

First Vanadium Commences Geophysical Survey Over its Gold Target on the Carlin Gold Trend, Nevada

Vancouver, British Columbia--(Newsfile Corp. - January 19, 2021) - First Vanadium Corp. (TSXV: FVAN) (OTCQX: FVANF) (FSE: 1PY) ("First Vanadium" or the "Company") is pleased to announce that it has commenced the Induced Polarization (IP) geophysical survey over its identified gold system on the Carlin Vanadium-Gold Property on the Carlin Gold Trend of Nevada. The IP survey should scope out the size and configuration of the overall system and define higher sulfide concentration detailing within it. This is the first ever IP survey conducted over this compelling target.

IP identifies areas of higher concentrations of disseminated sulfides which in Carlin-type gold systems are commonly associated with higher grade gold areas. Disseminated sulfides, in amounts typical of Carlin gold systems, have been visually logged in all seven reverse circulation holes testing the gold system. This, along with the assays, once received from all seven drill holes, will provide further guidance to subsequent drilling and evaluation of the large system.

The survey will cover 1 square mile, over the area of our drilling to date, and has been designed by Dave Mathewson and Jim Wright of Wright Geophysics. Jim Wright is a former Newmont geophysicist who specializes in Carlin-type systems. The survey is designed to penetrate as deep as 2,000 feet, to provide signals within the lower plate Rodeo Creek and Popovich rocks. These are the same rocks hosting the large deposits in the Carlin trend such as Gold Quarry and Gold Strike. The survey is expected to take approximately 3 weeks with final results available shortly thereafter. Jim Wright will receive data from the contractor daily in order to monitor its progress closely and adjust as he recommendations, for local anomaly detailing, to get the most out of the survey.

About First Vanadium Corp.

First Vanadium has an option to earn a 100% interest in the Carlin Vanadium Project, located in Elko County, 6 miles south from the town of Carlin, Nevada and Highway I-80. The Project lies in the Carlin Gold Trend. Approximately 9 million ounces comprised of multiple gold deposits, including past producing mines, are present near the FVAN property (5-15km). The Carlin Vanadium-Gold Project also hosts the Carlin Vanadium deposit.

ON BEHALF OF FIRST VANADIUM CORP.

per: "Paul Cowley"

CEO & President (778) 655-4311

This email address is being protected from spambots. You need JavaScript enabled to view it.

www.firstvanadium.com

Technical disclosure in this news release has been reviewed and approved by Dave Mathewson, a Qualified Person as defined by National Instrument 43-101, and Geological Advisor to the Company.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

Certain statements in this news release constitute "forward-looking" statements. These statements relate to future events or the Company's future performance and include the Company's ability to meet its obligations under the Access and Mineral Lease Agreement and the conditions required to exercise in full its option to acquire the Carlin Vanadium project, to finance and drill test the gold system and encounter potential gold zones in the system. All such statements involve substantial known and unknown risks, uncertainties and other factors which may cause the actual results to vary from those expressed or implied by such forward-looking statements. Forward-looking statements involve significant risks and uncertainties, they should not be read as guarantees of future performance or results, and they will not necessarily be accurate indications of whether or not such results will be achieved. Actual results could differ materially from those anticipated due to a number of factors and risks. Although the forward-looking statements contained in this news release are based upon what management of the Company believes are reasonable assumptions on the date of this news release, the Company cannot assure investors that actual results will be consistent with these forward-looking statements. The forward-looking statements contained in this press release are made as of the date hereof and the Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required under applicable securities regulations.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/72347

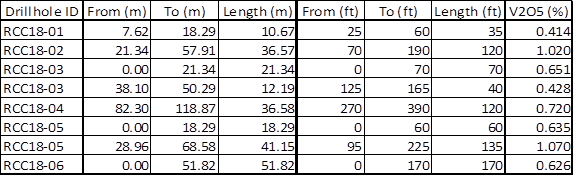

First Vanadium Options Gold Property from Mathewson in Battle Mtn - Eureka Gold Trend, Nevada

Vancouver, British Columbia--(Newsfile Corp. - January 14, 2021) - First Vanadium Corp. (TSXV: FVAN) (OTCQX: FVANF) (FSE: 1PY) ("First Vanadium" or the "Company") is pleased to announce that it is selectively strengthening its gold portfolio in Nevada by signing an Option Agreement exclusively with Dave Mathewson for a property he has held and planned to drill himself for a number of years in the Battle Mountain - Eureka Gold Trend. The option of the AVP Property will further strengthen Dave Mathewson's position and engagement in First Vanadium Corp. with additional stock in the Company and will spearhead and supervise the exploration on both AVP Property and the Carlin Vanadium-Gold Project.

Paul Cowley, President & CEO states, "We are very pleased to add this high-quality opportunity from Dave Mathewson who obviously has a proven eye for good gold prospects in Nevada. The terms are modest to manage, still allowing us to focus the bulk of our treasury on drilling the Carlin Vanadium-Gold Project. The Company plans to conduct a ground magnetics and gravity survey in early spring on AVP, followed by reverse circulation drilling in 5-10 holes in 1,500m (5,000ft) this summer. Drilling in the 1980's on AVP suggests mineralization remains open in almost all directions and according to Dave Mathewson, may represent the tip of the iceberg."

Mr. Mathewson is a renowned Nevada gold specialist and former Newmont Mining Corporation Regional Exploration Manager. Mr. Mathewson was instrumental in several significant gold discoveries in the Rain and Railroad Mining Districts in the southern portion of the Carlin Gold Trend. During the 1990's while at Newmont, Mr. Mathewson led the team which discovered the Tess, Northwest Rain, Saddle, and South Emigrant gold deposits in the Rain District, which total over 4 million ounces of gold. In 2009, he was a founder of Gold Standard Ventures Corp. (TSX: GSV) (NYSE: GSV) and served as its Vice President of Exploration until 2015. During this period, his exploration team discovered the North Bullion gold, Bald Mountain gold and copper, and Sylvania silver and copper deposits, as well as acquired the Pinion gold deposit, all in the Railroad District.

The AVP claim group, comprised of 40 unpatented lode claims, is located 23 kilometres southwest of Eureka, Nevada, within the southern extension of the Battle Mtn - Eureka Gold Trend and is specifically on the southern extension of the Cortez-Gold Bar Trend. The Battle Mtn - Eureka Gold Trend rivals the Carlin Gold Trend in gold production and prospectivity. Access around the entire AVP Property is easily obtained via existing roads and 2-track trails. The prospect area covers a 3.6 kilometre north-south stretch of the Mahogany range margin which exhibits silicified limestone but much is covered by a generally thin veneer of post-mineral gravel.

In the early 1980's, Bear Creek Exploration, the exploration arm of Kennecott, drilled 10 shallow (152m, 500ft) vertical holes in 9 sites over an area of about ½ square kilometre. Bedrock was encountered in all holes from depths of 12.2m (40ft) to a maximum of 126.5m (415ft). Four of the drill holes encountered favorable limestone host with significantly anomalous gold. One hole encountered 16.8m (55ft) of 0.5g/t Au (0.015ozAu/st), including 1.5m (5ft) of 1.23g/t Au (0.036ozAu/st). No follow-up drilling has been done since.

AVP Transaction

The Company has signed a five-year option agreement with Nevada Gold Ventures, LLC ("Nevada Gold"), exclusively owned by Dave Mathewson, whereby the Company has the option to acquire a 100% interest in the AVP Property by completing the following cash payments and share issuances to Nevada Gold and incurring the following exploration expenditures on the property:

a) On signing of an Option Agreement, pay US$25,000;

b) On receipt of approval from TSX Venture Exchange ("TSX-V"), issue 250,000 First Vanadium common shares;

c) On or before the first anniversary of TSX-V approval, spend US$250,000 in work commitments and issue an additional 250,000 common shares;

d) On or before the second anniversary of TSX-V approval, spend an additional US$250,000 in work commitments and issue an additional 250,000 common shares;

e) On or before the third anniversary of TSX-V approval, spend an additional US$250,000 in work commitments and issue an additional 250,000 common shares;

f) On or before the fourth anniversary of TSX-V approval, spend an additional US$250,000 in work commitments, issue an additional 500,000 common shares and pay US$25,000, and;

g) On or before the fifth anniversary of TSX-V approval, spend an additional US$1,000,000 in work commitments.

Nevada Gold will retain a 3% Net Smelter Return Royalty ("NSR") on any mineral products derived from the AVP Property. First Vanadium will have the right to purchase up to a 2% NSR for US$1.0 million for each 1% NSR prior to commencing commercial production, leaving Nevada Gold with a 1% NSR. The proposed transaction is subject to the acceptance of the TSX-V.

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/3372/72071_f557956564172a79_002full.jpg

About First Vanadium Corp.

First Vanadium has an option to earn a 100% interest in the Carlin Vanadium Project, located in Elko County, 6 miles south from the town of Carlin, Nevada and Highway I-80. The Project lies in the Carlin Gold Trend. Approximately 9 million ounces comprised of multiple gold deposits, including past producing mines, are present near the FVAN property (5-15km). The Carlin Vanadium-Gold Project also hosts the Carlin Vanadium deposit.

ON BEHALF OF FIRST VANADIUM CORP.

per: "Paul Cowley"

CEO & President

(778) 655-4311

This email address is being protected from spambots. You need JavaScript enabled to view it.

www.firstvanadium.com

Technical disclosure in this news release has been reviewed and approved by Dave Mathewson, a Qualified Person as defined by National Instrument 43-101, and Geological Advisor to the Company.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

Certain statements in this news release constitute "forward-looking" statements. These statements relate to future events or the Company's future performance and include the Company's ability to meet its obligations under the Access and Mineral Lease Agreement and the conditions required to exercise in full its option to acquire the Carlin Vanadium project, to finance and drill test the interpreted gold target model and to encounter potential gold zones shown in the gold model . All such statements involve substantial known and unknown risks, uncertainties and other factors which may cause the actual results to vary from those expressed or implied by such forward-looking statements. Forward-looking statements involve significant risks and uncertainties, they should not be read as guarantees of future performance or results, and they will not necessarily be accurate indications of whether or not such results will be achieved. Actual results could differ materially from those anticipated due to a number of factors and risks. Although the forward-looking statements contained in this news release are based upon what management of the Company believes are reasonable assumptions on the date of this news release, the Company cannot assure investors that actual results will be consistent with these forward-looking statements. The forward-looking statements contained in this press release are made as of the date hereof and the Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required under applicable securities regulations.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/72071

First Vanadium Provides Drilling Update at Its Gold Target on the Carlin Gold Trend, Nevada

Vancouver, British Columbia--(Newsfile Corp. - December 22, 2020) - First Vanadium Corp. (TSXV: FVAN) (OTCQX: FVANF) (FSE: 1PY) ("First Vanadium" or the "Company") is pleased to provide an update from the reverse circulation drill campaign on the north-south trending gold target corridor within the Carlin Vanadium-Gold Property on the Carlin Gold Trend of Nevada. The Company has just completed the seventh hole to a depth of 2500 feet. The drilling program will temporarily pause for the holidays and pending assay results, which are expected in January and February for the four holes completed in November and December (RC20-04 through RC20-07).

Results from RC20-01 through 03, previously reported, define a Carlin-style gold system with dimensions of at least 500 metres vertically and 1.4 kilometre in length. The gold target opportunity was conceptualized and now identified by renowned geologist and mine-finder Dave Mathewson, a former Newmont Regional Exploration Manager who is the Company's Geological Advisor and is the Qualified Person spearheading and supervising the gold drilling program.

Hole RC20-04, drilled eastward at a 55o angle, is located 830m south of hole RC20-01. RC20-05, drilled eastward at a 75o angle, is located 430m south of RC20-01. Hole RC20-06 is located from the same drill pad as RC20-05, drilling eastward but at a shallower angle of 60o. Hole RC20-07, drilled eastward at a 65o angle, is located 720m south of RC20-01.

Recent drilling continues to visually expand the size of the target zone, and high-grade gold zones representing feeder conduits to the system are being sought. The Company will continue to advance toward the discovery of high-grade zones by assessing incoming assays within the context of the broad zones of alteration that have been encountered within the drill holes. A geophysical Induced Polarization (IP) survey is scheduled in January. The IP survey will cover an area of 1 square mile and provide data as deep as 2,000 feet, into the lower plate rocks of Rodeo Creek Formation and the Popovich limestone. IP identifies areas of higher concentrations of disseminated sulfides which in Carlin-type gold systems are commonly associated with higher grade areas. This IP survey, along with the assays from all seven drill holes, will guide and optimize subsequent drilling to evaluate the large system.

About First Vanadium Corp.

First Vanadium has an option to earn a 100% interest in the Carlin Vanadium Project, located in Elko County, 6 miles south from the town of Carlin, Nevada and Highway I-80. The Project lies in the Carlin Gold Trend. Approximately 9 million ounces comprised of multiple gold deposits, including past producing mines, are present near the FVAN property (5-15km). The Carlin Vanadium-Gold Project also hosts the Carlin Vanadium deposit.

ON BEHALF OF FIRST VANADIUM CORP.

per: "Paul Cowley"

CEO & President

(778) 655-4311

This email address is being protected from spambots. You need JavaScript enabled to view it.

www.firstvanadium.com

Technical disclosure in this news release has been reviewed and approved by Dave Mathewson, a Qualified Person as defined by National Instrument 43-101, and Geological Advisor to the Company.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

Certain statements in this news release constitute "forward-looking" statements. These statements relate to future events or the Company's future performance and include the Company's ability to meet its obligations under the Access and Mineral Lease Agreement and the conditions required to exercise in full its option to acquire the Carlin Vanadium project, to finance and drill test the interpreted gold target model and to encounter potential gold zones shown in the gold model. All such statements involve substantial known and unknown risks, uncertainties and other factors which may cause the actual results to vary from those expressed or implied by such forward-looking statements. Forward-looking statements involve significant risks and uncertainties, they should not be read as guarantees of future performance or results, and they will not necessarily be accurate indications of whether or not such results will be achieved. Actual results could differ materially from those anticipated due to a number of factors and risks. Although the forward-looking statements contained in this news release are based upon what management of the Company believes are reasonable assumptions on the date of this news release, the Company cannot assure investors that actual results will be consistent with these forward-looking statements. The forward-looking statements contained in this press release are made as of the date hereof and the Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required under applicable securities regulations.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/70857

First Vanadium Drilling Identifies Gold System Stretching 1.4km at Its Gold Target on the Carlin Gold Trend, Nevada; Drilling Ongoing

Vancouver, British Columbia--(Newsfile Corp. - November 30, 2020) - First Vanadium Corp. (TSXV: FVAN) (OTCQX: FVANF) (FSE: 1PY) ("First Vanadium" or the "Company") is pleased to summarize results from drillholes RC20-02 and RC20-03 from the on-going first reverse circulation drill campaign on the north-south trending gold target corridor within the Carlin Vanadium-Gold Property on the Carlin Gold Trend of Nevada. Results from RC20-02 and RC20-03, 1.4 kilometres south from previously reported RC20-01, also display Carlin-style gold system alteration and metal signatures, interpreting the gold system to be in excess of 1.4 kilometres in length. The gold target opportunity was identified by renowned geologist and mine-finder Dave Mathewson, a former Newmont Regional Exploration Manager who is the Company's Geological Advisor and is the Qualified Person spearheading and supervising the gold drilling program.

Dave Mathewson states, "Results from RC20-01 and now RC20-02 and RC20-03 are providing some sense of dimensions to this large-scale Carlin-type gold system, early on. Hole RC20-01 shows a nearly 500m vertical dimension while holes RC20-02 and RC20-03 provide a 1.4 kilometre length. Drilling is on-going. In our efforts to vector to hot spots in the gold system, our current drilling campaign is progressing well, now on hole RC20-06."

On November 2, 2020, the Company announced results from its first reverse circulation drill hole, RC20-01, identifying the presence of a large-scale Carlin-type gold system at this location on the property. The hole exhibited 487m (1600ft) of favourable altered and mineralized lower plate rocks from 275m (900ft) depth, to the bottom of the hole at 762m (2500ft). Holes RC20-02 (vertical) and RC20-03 (-55o eastward), from the same pad 1.4 kilometres south of RC20-01, were drilled on the bases of the north-south trending gold target corridor and presence of nearby gold values with associated arsenic and mercury pathfinder metals in surface exposures and previous shallow drilling. As reported November 2, 2020 holes RC20-02 and RC20-03 were abandoned at 1160ft and 820ft, respectively, due to artesian conditions, and failed to penetrate much of the more favorable lower plate Rodeo Creek and none of the upper Popovich target units as hole RC20-01 had. However, the holes did display Carlin-style gold system alteration and metal signatures within the upper plate rocks and uppermost lower plate of probable Rodeo Creek rocks in RC20-02, confirming the gold system to also be present at this location. Hole RC20-02 exhibited moderate dolomite alteration with pyrite from 61m (200ft) depth, to the bottom of the hole. There were elevations in gold, silver, arsenic, mercury and zinc. Nearly continuous weakly elevated gold values were encountered in the intervals 56.4-153.9m (185-505ft), 283.5-309.4m (930-1015ft) and 326.1-353.6m (1070-1160ft), generally with associated elevated arsenic values. These metal elevations were not, in comparison, encountered in the upper plate rocks in RC20-01, suggesting that perhaps the system may be stronger in this southern location. Hole RC20-03 showed similar elevations in alteration, sulfides and metals as in RC20-02. The Company is planning to deepen RC20-03 with diamond drilling during milder weather conditions so that artesian water can be better managed.

On-Going Drilling

The Company announced the continuation of the drilling campaign a mere 4 days following the RC20-01 announcement, with hole RC20-06 now in progress. Hole RC20-04, drilled eastward at a 55o angle, is located 830m south of hole RC20-01. RC20-05, drilled eastward at a 75o angle, is located 430m south of RC20-01. Hole RC20-06 is located from the same drill pad as RC20-05, drilling eastward but at a shallower angle of 60o. Hole RC20-06 will thus add a third dimension and begin the vectoring process and improve the understanding of the architecture and width of the system. The drilling will apply Mr. Mathewson's gold model shown in the November 2, 2020 press release. Samples from holes RC20-04, 05 and a portion of 06 are in the ALS Global lab in Elko with results pending.

About First Vanadium Corp.

First Vanadium has an option to earn a 100% interest in the Carlin Vanadium Project, located in Elko County, 6 miles south from the town of Carlin, Nevada and Highway I-80. The Carlin Vanadium Project hosts the Carlin Vanadium deposit. A positive PEA on the vanadium resource was announced May 11, 2020.

Approximately 9 million ounces comprised of multiple gold deposits, including past producing mines, are present near the FVAN property (5-15km). The Gold Target on the FVAN property is supported by compelling science: a north-south structure with coincident gravity high and a 2km x 600m Carlin deposit-type hydrothermal alteration system (dolomite, gold, pathfinder metals, silicification) on FVAN property - all very typical of Carlin deposit-type plumbing system and gold deposits.

ON BEHALF OF FIRST VANADIUM CORP.

per: "Paul Cowley"

CEO & President

(778) 655-4311

This email address is being protected from spambots. You need JavaScript enabled to view it.

www.firstvanadium.com

Technical disclosure in this news release has been reviewed and approved by Dave Mathewson, a Qualified Person as defined by National Instrument 43-101, and Geological Advisor to the Company.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

Certain statements in this news release constitute "forward-looking" statements. These statements relate to future events or the Company's future performance and include the Company's ability to meet its obligations under the Access and Mineral Lease Agreement and the conditions required to exercise in full its option to acquire the Carlin Vanadium project, to finance and drill test the interpreted gold target model and to encounter potential gold zones shown in the gold model . All such statements involve substantial known and unknown risks, uncertainties and other factors which may cause the actual results to vary from those expressed or implied by such forward-looking statements. Forward-looking statements involve significant risks and uncertainties, they should not be read as guarantees of future performance or results, and they will not necessarily be accurate indications of whether or not such results will be achieved. Actual results could differ materially from those anticipated due to a number of factors and risks. Although the forward-looking statements contained in this news release are based upon what management of the Company believes are reasonable assumptions on the date of this news release, the Company cannot assure investors that actual results will be consistent with these forward-looking statements. The forward-looking statements contained in this press release are made as of the date hereof and the Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required under applicable securities regulations.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/69173

First Vanadium Corp. Provides Update and Information on Annual General Meeting of Shareholders

Vancouver, British Columbia--(Newsfile Corp. - November 27, 2020) - First Vanadium Corp. (TSXV: FVAN) (OTCQX: FVANF) (FSE: 1PY) ("First Vanadium" or the "Company") announces that with respect to its annual general meeting (the "Meeting") of shareholders ("Shareholders") scheduled to take place on Thursday, December 10, 2020 in Vancouver, British Columbia, the Company is encouraging Shareholders and proxyholders not to attend the Meeting in person, particularly if they are experiencing any COVID-19 symptoms.

In order to comply with the Orders of the British Columbia Provincial Health Officer currently in effect related to the COVID-19 pandemic, and in response to the additional directives of the Provincial and Federal governments and health authorities, the Meeting will not be open to the public. Access to the Meeting will be limited to essential personnel and registered Shareholders and proxyholders entitled to attend and vote at the Meeting. There will be strict limitations on the number of persons permitted entry to the Meeting in order to ensure adherence to social distancing requirements. It will also be mandatory for all persons in attendance at the Meeting to wear a face mask/covering.

In order to minimize group sizes and respect social distancing regulations, all Shareholders are urged to vote on the matters before the Meeting by proxy which can be submitted electronically, by mail, or by phone as further described in the Company's management information circular dated October 30, 2020, by no later than 10:00 a.m. (Vancouver time) on December 8, 2020.

Given the current exceptional circumstances and the requirement to mitigate COVID-19 pandemic risks, there will be no management presentation at the Meeting, nor will there be a question and answer session with management.

As the situation regarding COVID-19 is rapidly evolving, the Company reserves the right to implement additional precautionary measures related to the Meeting if deemed appropriate.

The Company thanks its valued Shareholders and apologizes for any inconvenience caused as a result of the precautionary safety measures taken in respect of the Meeting.

About First Vanadium Corp.

First Vanadium has an option to earn a 100% interest in the Carlin Vanadium Project, located in Elko County, 6 miles south from the town of Carlin, Nevada and Highway I-80. The Carlin Vanadium Project hosts the Carlin Vanadium deposit. A positive PEA on the vanadium resource was announced May 11, 2020.

Approximately 9 million ounces comprised of multiple gold deposits, including past producing mines, are present near the FVAN property (5-15km). The Gold Target on the FVAN property is supported by compelling science: a north-south structure with coincident gravity high and a 2km x 600m Carlin deposit-type hydrothermal alteration system (dolomite, gold, pathfinder metals, silicification) on FVAN property - all very typical of Carlin deposit-type plumbing system and gold deposits.

ON BEHALF OF FIRST VANADIUM CORP.

per: "Paul Cowley"

CEO & President

(778) 655-4311

This email address is being protected from spambots. You need JavaScript enabled to view it.

www.firstvanadium.com

Technical disclosure in this news release has been reviewed and approved by Paul Cowley, a Qualified Person as defined by National Instrument 43-101, and President, CEO and director of the Company.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

Certain statements in this news release constitute "forward-looking" statements. These statements relate to future events or the Company's future performance and include the Company's ability to meet its obligations under the Access and Mineral Lease Agreement and the conditions required to exercise in full its option to acquire the Carlin Vanadium project, to finance and drill test the interpreted gold target model and to encounter potential gold zones shown in the gold model . All such statements involve substantial known and unknown risks, uncertainties and other factors which may cause the actual results to vary from those expressed or implied by such forward-looking statements. Forward-looking statements involve significant risks and uncertainties, they should not be read as guarantees of future performance or results, and they will not necessarily be accurate indications of whether or not such results will be achieved. Actual results could differ materially from those anticipated due to a number of factors and risks. Although the forward-looking statements contained in this news release are based upon what management of the Company believes are reasonable assumptions on the date of this news release, the Company cannot assure investors that actual results will be consistent with these forward-looking statements. The forward-looking statements contained in this press release are made as of the date hereof and the Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required under applicable securities regulations.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/69105

First Vanadium Resumes Drilling on its Gold Target in the Carlin Gold Trend, Nevada

Vancouver, British Columbia--(Newsfile Corp. - November 6, 2020) - First Vanadium Corp. (TSXV: FVAN) (OTCQX: FVANF) (FSE: 1PY) ("First Vanadium" or the "Company") is pleased to announce that the Company has resumed reverse circulation drilling on its gold target below the vanadium resource on its Carlin Vanadium-Gold Property on the Carlin Gold Trend in Nevada. The gold target was identified by renowned geologist and mine-finder Dave Mathewson, a former Newmont Regional Exploration Manager who is the Company's Geological Advisor and is the Qualified Person spearheading and supervising the gold drilling program.

On November 2, 2020, the Company announced, that from its first reverse circulation drill hole, it had confirmed the presence of a large-scale Carlin-type gold system on the property. On the strength of those results, drilling has resumed with multiple holes planned, now shifting to assess the extent and intensity of the system and to begin vectoring towards its heart. The drilling will apply Mr. Mathewson's gold model shown in the November 2, 2020 press release.

About First Vanadium Corp.

First Vanadium has an option to earn a 100% interest in the Carlin Vanadium Project, located in Elko County, 6 miles south from the town of Carlin, Nevada and Highway I-80. The Carlin Vanadium Project hosts the Carlin Vanadium deposit. A positive PEA on the vanadium resource was announced May 11, 2020.

Approximately 9 million ounces comprised of multiple gold deposits, including past producing mines, are present near the FVAN property (5-15km). The Gold Target on the FVAN property is supported by compelling science: a north-south structure with coincident gravity high and a 2km x 600m Carlin deposit-type hydrothermal alteration system (dolomite, gold, pathfinder metals, silicification) on FVAN property - all very typical of Carlin deposit-type plumbing system and gold deposits.

ON BEHALF OF FIRST VANADIUM CORP.

per: "Paul Cowley"

CEO & President

(778) 655-4311

This email address is being protected from spambots. You need JavaScript enabled to view it. www.firstvanadium.com

Technical disclosure in this news release has been reviewed and approved by Paul Cowley, a Qualified Person as defined by National Instrument 43-101, and President, CEO and director of the Company.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

Certain statements in this news release constitute "forward-looking" statements. These statements relate to future events or the Company's future performance and include the Company's ability to meet its obligations under the Access and Mineral Lease Agreement and the conditions required to exercise in full its option to acquire the Carlin Vanadium project, to finance and drill test the interpreted gold target model and to encounter potential gold zones shown in the gold model . All such statements involve substantial known and unknown risks, uncertainties and other factors which may cause the actual results to vary from those expressed or implied by such forward-looking statements. Forward-looking statements involve significant risks and uncertainties, they should not be read as guarantees of future performance or results, and they will not necessarily be accurate indications of whether or not such results will be achieved. Actual results could differ materially from those anticipated due to a number of factors and risks. Although the forward-looking statements contained in this news release are based upon what management of the Company believes are reasonable assumptions on the date of this news release, the Company cannot assure investors that actual results will be consistent with these forward-looking statements. The forward-looking statements contained in this press release are made as of the date hereof and the Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required under applicable securities regulations.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/67625

First Vanadium Identifies Large-Scale Carlin-Type Gold System with First Hole on its Property on the Carlin Gold Trend, Nevada

Vancouver, British Columbia--(Newsfile Corp. - November 2, 2020) - First Vanadium Corp. (TSXV: FVAN) (OTCQX: FVANF) (FSE: 1PY) ("First Vanadium" or the "Company") is pleased to announce results from its first reverse circulation drill hole designed to provide an initial penetration into a potential gold target opportunity below the vanadium resource on its Carlin Vanadium-Gold Property on the Carlin Gold Trend in Nevada. The gold opportunity was identified by renowned geologist and mine-finder Dave Mathewson, a former Newmont Regional Exploration Manager who is the Company's Geological Advisor and is the Qualified Person spearheading and supervising the gold drilling program.

Dave Mathewson states, "With our very first hole we have drilled into a significant large-scale Carlin-type gold system at a reasonable depth, much like I have seen elsewhere in the Carlin Gold Trend. Typical Carlin-type deposit system geochemistry and alteration were encountered in this hole, indicated by gold (Au), arsenic (As), mercury (Hg), antimony (Sb), and thallium (Tl). This, along with other critical features including key rock formations, collapse brecciation and strong alteration (silica-pyrite+/-arsenopyrite-dolomite-realgar) make it potentially analogous to other important Carlin-type deposit systems such as Nevada Gold Mines' massive Gold Quarry deposit (13 miles to the northwest). Because of the significance of this first hole, we are immediately resuming reverse circulation drilling for the purpose of assessing the extent and strength of the system and to begin vectoring into hot spots within the system."

Highlights from RC20-01:

- The highest levels of gold and associated pathfinder metals were in the best possible location, specifically the upper silicified, collapse brecciated lower plate Popovich Limestone. Dave Mathewson is encouraged by the gold numbers encountered, which are indicative of the fringes of a large-scale gold system.

- The four principal elements for Carlin-type Gold deposits are 1) system, 2) host, 3) structure, and 4) depth. All four elements have been confirmed with RC20-01.

- Very thick intervals of moderately to highly altered lower plate rock, locally containing significantly anomalous gold and associated Carlin-type deposit pathfinder elements start from the surface and continue to the bottom (TD) of the hole at 2500' (762m).

- Upper plate Woodruff Formation was encountered, followed by lower plate Rodeo Creek Formation and Popovich Formation, the same rock units as at Gold Quarry and Gold Strike, along the Carlin Gold Trend. Rodeo Creek and Popovich units are the principal mineralized units at Gold Quarry and Gold Strike.

- The depths of lower plate Rodeo Creek and Popovich hosts encountered are considered reasonable for Carlin-type gold deposits.

- The structure considered responsible for localizing the alteration system on the Carlin Vanadium-Gold Property is a north-south-oriented corridor of alteration and faulting cutting through the property.

Today, the Company will post on its website www.firstvanadium.com a short video by the CEO and Dave Mathewson speaking on this news release.

A schematic cross-section follows of Mr. Mathewson's Carlin gold target model that he has used successfully to find Carlin-type deposits and modified with the information gained from RC20-01. According to his extensive experience in Carlin gold systems, Mr. Mathewson interprets and positions this hole relative to the potential gold zones that may exist on the property. This model will be used to direct further exploration drilling.

Theorized cross-section South Carlin Gold Target Model

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/3372/67324_997d624284713bb9_002full.jpg

Details

RC20-01 started in upper plate Woodruff Formation, host of the vanadium deposit, encountering the Roberts Mountain Fault at about 975' (297m) depth. The Woodruff unit gradually became more silicified and pyrite-bearing with depth and had intermittent elevations in gold, arsenic and mercury.

Lower plate Rodeo Creek Formation was cut in RC20-01 from about 975' (297m) to 2025' (617m) depth. The unit was moderate to strongly silicified, pyrite+/- arsenopyrite-bearing and with moderate to strong consistent arsenic and mercury elevations, typical of Carlin-style gold systems, including secondary Fe-dolomite, decalcification and collapse brecciation. Eighty-five percent of the unit was elevated in gold between 5-146 ppb.

Highly altered Popovich limestone was cut in RC20-01 from 2025' (617m) to the end of the hole at 2500' (762m). This unit was very strongly silicified, pyrite+/-arsenopyrite-bearing and with moderate to strong consistent arsenic and mercury elevations and stronger longer sections of collapse brecciation and Fe-dolomite.

The Popovich limestone cut in RC20-01 was more consistently elevated in gold between 2050-2195' ((a 145' (44.2m) section) grading 0.16 g/t Au, including 2055'-2095' (626-639m) grading 0.3 g/t Au and 2165'-2190' (660-668m) grading 0.26 g/t Au. This mineralization is present in the best possible location, specifically the upper silicified, collapse brecciated lower plate Popovich Formation.

This first pass reverse circulation drill program consisted of two vertical holes spaced 4,593' (1,400m) apart along the projection of the north-south master structure. RC20-01 reached the planned depth of 2500' (762m). RC20-02 located 330' (100m) from silicified gold-bearing surface exposures with arsenic and mercury, reached a depth of 1160' (354m) where it was abandoned due to artesian conditions. Realgar and arsenopyrite were noted periodically from 450' (137m) to the bottom of RC20-02, with the last 15' (4.6m) exhibiting 20-80% realgar. Realgar and arsenopyrite minerals are typical in Carlin gold systems associated with gold. To reach the original intended target depth, RC20-03 was drilled from the same site as RC20-02 at a 60o angle towards the gold-bearing silicified surface exposures. This hole also encountered artesian conditions and was abandoned at 840' (256m). Casing was left in the hole so that this hole could be deepened in the future. Assays for holes RC20-02 and RC20-03 are pending.

The drilling program has been supervised by Mr. Dave Mathewson, MSc., Geological Advisor for the Company and Qualified Person for the program. Industry standard quality control and quality assurance protocols have been followed in handling, sampling and shipping the chip. Samples were analyzed by ALS Global.

Drilling Resuming This Week

With the first pass drilling confirming that a large-scale Carlin style gold system is present on the property, the Company is immediately resuming reverse circulation drilling with the design to further assess the extent and strength of the system and to begin vectoring towards the heart of the system.

About First Vanadium Corp.

First Vanadium has an option to earn a 100% interest in the Carlin Vanadium Project, located in Elko County, 6 miles south from the town of Carlin, Nevada and Highway I-80. The Carlin Vanadium Project hosts the Carlin Vanadium deposit. A positive PEA on the vanadium resource was announced May 11, 2020.

Approximately 9 million ounces comprised of multiple gold deposits, including past producing mines, are present near the FVAN property (5-15km). The Gold Target on the FVAN property is supported by compelling science: a north-south structure with coincident gravity high and a 2km x 600m Carlin deposit-type hydrothermal alteration system (dolomite, gold, pathfinder metals, silicification) on FVAN property - all very typical of Carlin deposit-type plumbing system and gold deposits.

ON BEHALF OF FIRST VANADIUM CORP.

per: "Paul Cowley"

CEO & President

(778) 655-4311

This email address is being protected from spambots. You need JavaScript enabled to view it.

www.firstvanadium.com

Technical disclosure in this news release has been reviewed and approved by Dave Mathewson., a Qualified Person as defined by National Instrument 43-101, and Geological Advisor to the Company.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information